As we watch the market rise and fall, sometimes we see a big drop – the perfect opportunity to push some capital into the market and make some dividend growing investments. However, when this happens, many will watch and become lost in the vast amount of opportunities and potential investments. Which one is the best fit? Which one has the greatest expected dividend growth? These exact queries are the reason it’s so incredibly useful to make or follow a stock watch list every month, so when opportunities present themselves in abundance you know where to put your money.

Following are my picks for the month of February; these stocks are in no way recommendations; they are simply the stocks that I watch throughout the month and am hopeful to allocate capital to if given the chance and opportunity.

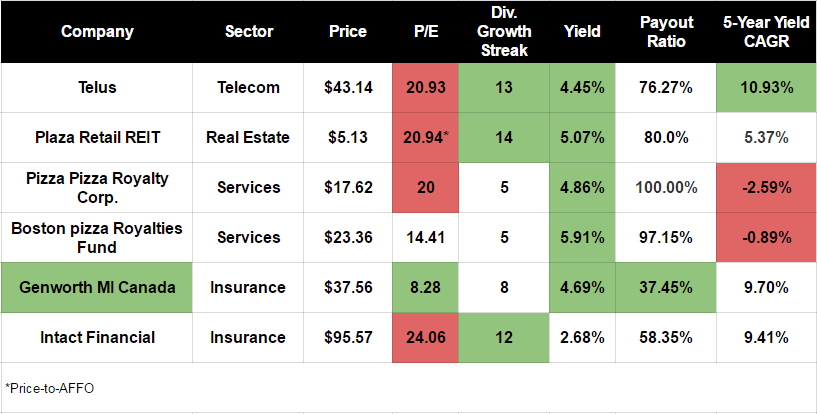

My stock watch list follows a simple formula; of which the details can be read below. Things I like are coded in green, while things I dislike are coded in red. Companies which add up to 3 or more points (things I like – things I dislike) have their name coded in green, and I generally considered to be high-quality assets at a good valuation.

Things I like are:

- P/E below 10

- Yield above 4.00%

- Payout ratio below 50%

- 5-Year Yield Growth above 10%

- 10-Year Dividend Growth Streak

Things I dislike are:

- P/E above 20

- Payout Ratio above 80%

Stock Watch List (Canadian Market)

Our attractively valued high-quality asset this month is Genworth MI Canada (MIC.TO).

Genworth MI Canada just only entered my radar as I saw it’s share price rise 6.7% following their Q4 release, which saw net income rise 43% Y/Y. It is a mortgage insurance company which has increased its dividend every year since it’s IPO in 2009. It boasts a safe payout ratio, high yield, nearly 10% dividend growth, a very low P/E of 8.3 and is closing in on a 10-year dividend growth streak.

Intact Financial (IFC.TO) is another insurer but trades at a much higher multiple, and in effect, a lower dividend by an entire 2% more. The payout ratio is also higher and it appears to have a lower 5-year yield growth. It does beat MIC, though, in it’s dividend growth streak hitting that sweet spot above 10 straight years.

Telus (T.TO) came in a close second to Genworth MI Canada, but with it’s most recent earnings release coming in very low, the P/E has shot up and is now just above 20. Even though a large reason the P/E has shot up is because earnings coming in low, due to a one-time payment to employees in exchange for salary freezes until December 2018, I think the stock can drop a little bit more before I pick up any.

Plaza Retail REIT (PLZ.UN) is my favourite REIT currently in my portfolio, and I would be comfortable doubling or even tripling my position. It is valued using Price-to-AFFO rather than P/E due to being a real estate trust. It has a healthy yield and payout ratio, and is one of the rare Canadian REITs with a significant dividend growth streak of 14 years.

For the first time I did some research into the restaurant royalty companies in Canada. Boston Pizza (BPF.UN) & Pizza Pizza (PZA) appeared to offer the best of what a royalty fund could: a very high dividend, a developing dividend streak of 5 years. The one reason that both the dividend growth streak is only 5 years and that the 5-year yield growth is negative is due to the companies restructuring in response to new/updated tax laws in Canada. Pizza Pizza has a much higher PE however. There are better metrics than PE to value a royalty company though.

The payout ratios are aimed at being around 100% , since they have no or very little employees and capital costs as it is revenue royalties (and this is the reason why they are not penalized for having extremely high payout ratios – it is intentional).

A &W Revenue Royalties Income Fund (AW.UN) deserves a shout out as well but recently has been stretching its valuation and would merit more due diligence.

Stock Watch List (U.S. Market)

While no stocks that I’m currently observing in the U.S. adds up to 3 points, these all have their own different strengths and reasons for owning. I bought shares in Apple (AAPL) twice in the past two months and believe I’m fully covered there now as it’s my fourth largest stock position in The Dividend Beginner portfolio.

Microsoft (MSFT) looks very attractive as well, with a really good dividend growth streak of 15 years and a tremendous 5-year yield CAGR of 16.7% despite being a Technology stock. Unfortunately the high P/E of 30 has me cautious and waiting to see where things go in the near-term.

Of course, Johnson & Johnson (JNJ) has interested me for a while now but I think that there is more growth in other names. JNJ is a very long-term hold defensive position with moderate growth. The dividend growth streak is one of the best in the game and the payout ratio is incredibly reasonable. We can see from the chart, however, that it has the poorest dividend growth out of this list.

Wells Fargo (WFC), Bank of America (BAC), and the other U.S. banks warrant a bit more research with the moves that President Trump is making in banking deregulation as the industry could have a humongous boom, but we must beware of any bubbles that may form (if not already in one). I consider them to have decent P/Es in the 15 range. The rising rate environment is another catalyst to increase earnings for the U.S. banks.

If you find comfort in holding a stock watch list through each month, I implore you to subscribe to The Dividend Beginner newsletter, and you will receive my monthly stock watch lists directly in your e-mail inbox at the time of posting.

[mc4wp_form id=”709″]

How do my fellow investors’ watch lists look like? What are you thinking of buying this month? Why?

I’ve been wanting to get some Microsoft myself but am also wary of it being a tad expensive right now. A few dividend gurus seem to be high on Genworth these days . . . I hadn’t heard of it until recently!

Very nice little analysis you have done here. I like the look of some of these stocks but as you have pointed out, maybe a little on the expensive side at the moment.

man just stumbled on your site. great analysis!

Thanks. I like the looks of microsoft that p.e is a little to high atm tho like you said.